What's in this article?

In 2024, 38% of mortgage lenders have adopted artificial intelligence in their operations, jumping from just 15% the previous year. Yet despite this rapid digital adoption, many mortgage companies are discovering that implementing new technology without proper strategy leads to costly failures, frustrated staff, and dissatisfied borrowers.

The mortgage industry stands at a critical crossroads where digital transformation can either streamline operations and enhance customer experience or create expensive disasters that set companies back for years. Understanding the common pitfalls and implementing proven strategies can mean the difference between competitive advantage and costly setbacks.

The Price of Poor Planning

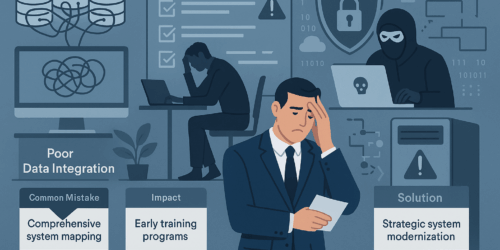

Digital transformation failures in mortgage lending typically stem from five critical mistakes. Poor data integration tops the list, with many companies struggling to connect new AI-powered tools with existing legacy systems. This creates process disruptions, incomplete data transfer, and operational gaps that can take months to resolve.

Change management represents the second major failure point. Companies often underestimate the human element of technological change, failing to prepare staff for new workflows and responsibilities. This leads to user resistance, decreased productivity, and systems that never reach their full potential.

Cybersecurity oversight creates the third major risk. As mortgage companies digitize sensitive borrower data, inadequate security measures expose them to breaches that damage trust and trigger regulatory penalties. The financial and reputational costs of security failures often exceed the initial technology investment.

| Common Mistake | Impact | Solution |

| Poor Data Integration | Process disruptions, incomplete automation | Comprehensive system mapping and phased integration |

| Inadequate Change Management | Staff resistance, productivity decline | Early training programs and clear communication |

| Weak Cybersecurity | Data breaches, compliance violations | Advanced encryption and threat detection systems |

| Legacy System Neglect | Operational bottlenecks, partial automation | Strategic system modernization planning |

| Fragmented Implementation | Siloed processes, limited efficiency gains | Holistic process redesign approach |

Success Through Strategic Implementation

Leading mortgage companies take a dramatically different approach to digital transformation. They begin with holistic process redesign rather than piecemeal automation, reimagining entire workflows to maximize technology benefits.

Successful digital transformation requires customer-centric thinking. Top-performing lenders design solutions that serve both digital-native borrowers and those who need additional guidance, maintaining satisfaction across all customer segments while driving efficiency gains.

AI and machine learning implementation in mortgage processing has proven particularly effective when applied strategically. Advanced underwriting systems now process applications with greater accuracy and speed, while automated data extraction reduces manual entry errors and accelerates document processing.

The most successful companies implement technology using agile methodology with phased rollouts. This approach allows for continuous feedback loops, rapid problem-solving, and steady progress toward full digital integration without overwhelming staff or disrupting operations.

Emerging Technology Trends Reshaping Mortgages

Predictive analytics has emerged as a game-changer for forward-thinking lenders. These systems identify the fastest loan pathways, anticipate borrower needs, and improve retention rates by proactively addressing potential issues before they become problems.

Blockchain technology is gaining traction for secure documentation and settlement processes. While still emerging, blockchain offers unprecedented transparency and fraud prevention capabilities that could revolutionize mortgage transactions.

Enhanced regulatory technology, often called RegTech, helps lenders shift from reactive compliance to proactive risk management. These systems streamline audits, automate compliance documentation, and reduce the burden of regulatory oversight while improving accuracy.

Modern borrower portals and mobile applications have become essential competitive tools. These platforms allow customers to track loan progress, upload documentation, and communicate directly with loan officers, significantly improving satisfaction and reducing processing delays.

Frequently Asked Questions

What percentage of mortgage companies are using AI in 2024?

As of 2024, 38% of mortgage lenders have implemented artificial intelligence in their operations, representing a significant increase from 15% in 2023.

How long does it typically take to implement a new loan origination system?

Industry data suggests that full loan origination system overhauls can often be completed in less than six months, particularly during periods of lower loan volumes.

What are the biggest risks of digital transformation in mortgage lending?

The primary risks include poor data integration with legacy systems, inadequate staff preparation, cybersecurity vulnerabilities, and fragmented implementation that fails to deliver expected efficiency gains.

Which technologies are most important for mortgage companies in 2025?

Key technologies include AI for underwriting and fraud detection, automated document processing systems, predictive analytics, enhanced cybersecurity platforms, and customer-facing digital portals.

How can mortgage companies avoid digital transformation failures?

Success requires holistic planning, comprehensive staff training, robust cybersecurity measures, customer-centric design, and agile implementation with continuous feedback loops.

Transform Your Digital Strategy Today

Digital transformation in mortgage lending demands more than new technology—it requires strategic vision, careful planning, and expert execution. Companies that approach transformation holistically, invest in both technology and people, and prioritize security and user experience position themselves for long-term competitive advantage.

The mortgage industry’s digital evolution continues accelerating, and companies that fail to adapt risk falling permanently behind their competitors. However, those that learn from common mistakes and implement proven strategies can achieve remarkable improvements in efficiency, customer satisfaction, and profitability.

Schedule a Digital Transformation Consultation → to discover how ProPair.ai can help you avoid costly mistakes and maximize your technology investment.