What's in this article?

The mortgage industry stands at a critical inflection point. While origination costs have surged 35% since 2021, forward-thinking lenders are discovering a powerful solution: artificial intelligence automation. Companies implementing comprehensive AI systems report an extraordinary 70% reduction in origination costs, with the average lender saving $3,250 per loan through intelligent automation.

This transformation extends far beyond simple cost savings. AI-powered mortgage companies achieve 97% workflow coverage across their entire lending process, delivering personalized borrower experiences that improve satisfaction by up to 72%. The question isn’t whether AI will reshape mortgage lending—it’s how quickly your organization can harness its potential.

The AI Revolution Transforming Mortgage Operations

Modern mortgage lending faces unprecedented challenges: increasing regulatory complexity, rising operational costs, and borrower demands for digital-first experiences. Manual processes that once defined the industry now represent bottlenecks that smart lenders are systematically eliminating through strategic AI implementation.

Machine learning algorithms now analyze thousands of data points instantly, replacing weeks of manual underwriting with hours of intelligent analysis. Natural language processing transforms document-heavy workflows, automatically extracting and verifying information from tax returns, paystubs, and financial statements. Computer vision technology reads handwritten forms with greater accuracy than human processors, while generative AI creates personalized borrower communications and interprets complex lending guidelines in real-time.

Core Areas Where AI Automation Drives Results

Intelligent Underwriting and Risk Assessment

AI-powered systems revolutionize traditional underwriting by analyzing borrower profiles through machine learning models trained on millions of loan decisions. These systems identify risk patterns invisible to humans, enabling more accurate lending decisions while reducing processing time from days to hours.

Document Processing Excellence

AI-driven document processing enables automatic extraction, classification, and verification across W-2s, bank statements, appraisals, and more.

| Document Type | AI Processing Capability | Manual vs AI Time Savings |

| Income Verification | Automatic extraction from paystubs, tax returns | 85% reduction in processing time |

| Asset Documentation | Bank statement analysis and verification | 78% faster completion |

| Property Appraisals | Data extraction and comparative analysis | 92% improvement in accuracy |

| Credit Documentation | Automated credit report analysis | 90% reduction in review time |

Advanced Fraud Detection

AI systems continuously learn from emerging fraud patterns, minimizing false positives and catching anomalies undetectable by traditional methods.

Compliance Automation

AI platforms track regulatory changes in real time, using NLP to interpret guidelines and flag potential risks. This proactive compliance management reduces legal exposure and manual oversight.

Implementation Strategies That Work

Data Integration Foundation

Smart lenders invest in cloud-based integration platforms to unify data across LOS, CRM, and underwriting systems—eliminating silos and powering accurate AI insights.

Choosing the Right Technology Partners

Proven platforms like TRUE.ai and Addy integrate directly with LOS systems and deliver NLP-driven automation, dynamic workflows, and compliant decision-making at scale.

Managing Change Effectively

Successful AI implementation includes transparent communication, staff training, and a clear focus on how automation enhances—not replaces—human expertise.

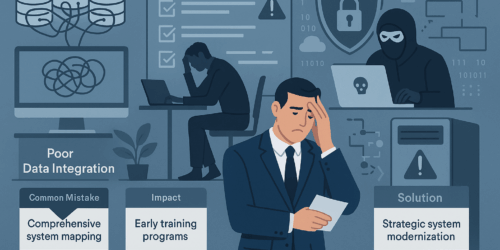

Overcoming Common Implementation Challenges

- Security & Privacy: Platforms must meet SOC2 and mortgage-specific compliance standards. Regular audits and strict vendor selection mitigate data risks.

- Regulatory Oversight: Maintain human-in-the-loop controls for high-risk decisions. Document AI recommendations to ensure explainability and fairness.

- Legacy System Compatibility: Use API-based connectors and cloud tools to overlay modern AI onto existing infrastructure without full system replacement.

The Future of AI in Mortgage Lending

Within the next 2-3 years:

- 90%+ of loan processing tasks will be automated

- Closing timelines will shrink 40-50%

- Borrowers will receive hyper-personalized loan offers using predictive analytics and open banking data

AI will also unlock dynamic pricing, inclusive lending options, and proactive fraud detection as it continues to evolve.

Frequently Asked Questions

How quickly can mortgage companies see ROI from AI implementation?

Most report ROI within 6–12 months, driven by cost reductions and faster loan cycles. Average savings: $3,250 per loan.

Will AI automation replace jobs?

No—AI enhances productivity by eliminating repetitive tasks. Human expertise remains critical in decision-making and client service.

How does AI handle changing regulations?

Top platforms monitor and translate new guidelines in real time using NLP and automation to update workflows.

What about borrower acceptance of AI?

Studies show 72% higher satisfaction when AI improves speed, transparency, and responsiveness in the lending process.

Can small lenders afford AI?

Yes. Scalable, cloud-based platforms make AI accessible to small and mid-sized lenders with fast payback periods.

Transform Your Mortgage Operations Today

The mortgage industry’s AI revolution isn’t coming—it’s here. Companies that embrace intelligent automation now will dominate tomorrow’s competitive landscape, while those clinging to manual processes will struggle with rising costs and declining efficiency.

ProPair.ai specializes in guiding mortgage companies through strategic AI implementation that delivers measurable results. Our comprehensive platform assessment identifies the highest-impact automation opportunities for your specific business model, ensuring maximum ROI from day one.